Thinking about adding EVs to your fleet but unsure of the financial impact?

Revolv’s EV Cost Savings Calculator makes it simple to see the potential benefits of fleet electrification. Just select an EV model, the fuel type you’re replacing, and the state in which you operate, and you’ll instantly receive clear projections for fuel and maintenance savings. For even greater accuracy, you can override our default industry benchmarks with data from your existing ICE[1] fleet for a fully customized analysis.

This practical calculator helps you quickly understand the economic advantages of transitioning to EVs—and how electrification can align with your company’s financial and sustainability goals.

Discover your fleet's savings potential: Calculate now!

Vehicle information

Fuel & energy prices

ICE vehicle details

EV details

Fuel savings

Maintenance savings

Emissions

Select a vehicle to get started

FAQs for fleets transitioning from ICE vehicles to EVs

The largest areas of savings for fleets switching from internal combustion engine (ICE) vehicles to electric vehicles (EVs) are fuel (energy) costs and maintenance. According to the U.S. Department of Energy, EVs cost approximately 40% less per mile in maintenance than conventional gas or diesel vehicles due to fewer moving parts and reduced routine service requirements.

EVs also deliver superior fuel economy, especially in stop-and-go duty cycles typical of delivery, municipal, and commercial fleets. Additionally, electricity prices tend to be more stable than gasoline or diesel, allowing fleet managers in the U.S. to better forecast energy costs and optimize long-term total cost of ownership (TCO).

Incentives are a key driver in reducing the total cost of ownership (TCO) for electric vehicle (EV) fleets. Federal, state, and utility programs can significantly offset vehicle purchase costs, charging infrastructure investments, and operational expenses. With new funding programs launching in 2025, fleets have unprecedented opportunities to maximize savings.

Revolv helps fleet operators capture every available incentive by managing applications, ensuring compliance, and streamlining the process—removing administrative burdens while unlocking maximum financial benefits. Expanded programs in New York, California, and Washington are expected to provide substantial funding opportunities for EV fleets. Learn more about these updates in Revolv’s market pulse report.

Charging infrastructure plays a critical role in the total cost of ownership (TCO) for electric vehicle (EV) fleets. While upfront investment in chargers and site upgrades can be significant, a well-planned charging strategy becomes a powerful lever for long-term savings. By right-sizing equipment, coordinating with utilities, and taking advantage of off-peak electricity pricing, fleet operators can substantially lower energy costs.

Research from the Rocky Mountain Institute (RMI) shows that fleets implementing depot-based overnight charging strategies can cut fueling costs by more than 50% compared to diesel. In addition, smart charging software and utility partnerships can further optimize load management, reduce demand charges, and future-proof operations as fleets scale.

Electric vehicle (EV) resale values remain an important consideration for fleets evaluating total cost of ownership (TCO). Historically, used EVs have experienced steeper depreciation than internal combustion engine (ICE) vehicles, according to Cox Automotive. However, industry data shows positive trends: as battery technology improves, charging infrastructure expands, and more EV models enter the secondary market, values are expected to stabilize.

Another factor supporting EV residual values is the growth of second-life battery applications. Even after an EV’s driving life, its battery can be repurposed for energy storage—capturing value beyond the vehicle itself. This potential for extended lifecycle value makes EVs increasingly attractive for fleets focused on long-term savings, sustainability, and energy resilience.

Electric vehicles (EVs) generally experience less unscheduled downtime than internal combustion engine (ICE) vehicles because they have fewer moving parts and mechanical components that can fail. According to Utilimarc’s Electric Vehicle Consortium, member fleets reported that their EVs went an average of 21 days longer between maintenance visits compared to ICE vehicles in 2024.

Lower downtime means higher vehicle availability, allowing fleets to rely on fewer backup vehicles, spread fixed costs such as insurance and depreciation across more revenue-generating miles, and reduce scheduling buffers. Over a vehicle’s lifecycle, these advantages increase utilization and lower cost per mile, strengthening the total cost of ownership (TCO) benefits of EVs. For more on maintenance and downtime comparisons, see Automotive Fleet’s EV Insights.

Utility rate structures, particularly demand charges, can significantly affect EV fleet charging costs. Demand charges are fees based on the highest power draw during a billing cycle and can be especially costly for high-power fleet depots or sites using DC fast charging. In some cases, demand charges account for over 70% of monthly electricity bills for charging operators.

Unmanaged charging during peak periods can quickly escalate costs. Fleets can lower expenses by shifting charging to off-peak hours, staggering vehicle charging schedules, and using energy management software, which helps flatten peak demand, reduce demand charges, and optimize total cost of ownership (TCO) for EV fleets. For a comprehensive, nationwide guide on managing EV fleet charging infrastructure, refer to the U.S. Department of Energy’s Blueprint 4A How-To Guide, which offers strategies for optimizing charging plans and mitigating demand charges.

See how far EVs can take your fleet

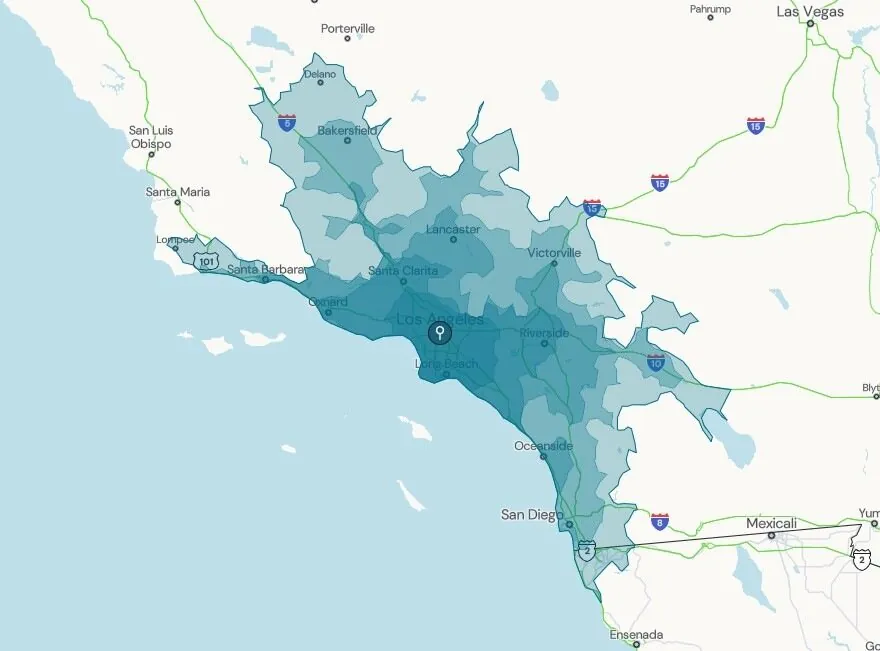

Don’t let range anxiety stop you from electrifying your fleet and reducing annual operating costs. See for yourself what vehicle models can meet your fleet’s needs.

1. Internal combustion engine

2. EIA: U.S. Energy Information Administration Gasoline and Diesel Fuel Update

3. EIA: U.S. Energy Information Administration Electricity Data Browser

Disclaimer: Revolv’s EV Cost Savings Calculator is intended only to provide an estimate of potential savings. Actual results may vary, and customers may not realize the same level of energy savings or carbon emission reductions. Vehicle data and electricity rates are subject to change and may not account for tiered or time-of-use pricing.